Marketing ROI: A Guide to The Big 3 Revenue Metrics

As a responsible business leader, you want to know the ROI of your marketing. You want to feel confident that your marketing investments lead to meaningful engagement that converts to revenue and healthy growth. Unfortunately, this doesn’t always prove as simple as it sounds.

The challenge with measuring marketing’s effectiveness isn’t usually a lack of data. In fact, it’s typically the opposite. Businesses today have so much data available that they’re often blinded by all of the metrics they could track. Just because almost every marketing activity is now trackable doesn’t mean every data point is important.

Measuring marketing’s effectiveness starts with understanding which overall revenue metrics are most meaningful to your business, why, and how you can use these metrics to optimize your marketing activities and accelerate growth.

In this guide to The Big 3 Revenue Metrics, we’ll cover:

* What happens when businesses don’t track the right metrics

* The importance of understanding your existing customers

* The three revenue metrics your business should be tracking

- Time To Convert / Close (TTC)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV)

* How Authentic built its methodology to support these metrics and your business

Without defined metrics, there are random acts of marketing

When businesses get lost in the sea of data available to them, they often struggle to create a concise and actionable marketing dashboard. They don’t know which metrics actually matter or which to use to guide future decisions.

Unfortunately, strategic marketing is nearly impossible without defined performance metrics. Businesses can’t assess whether marketing is positively impacting their objectives, and without this insight, marketing can’t strategically determine which activities and channels to invest more or fewer resources into.

As a result, businesses often commit random acts of marketing. Their marketing activities are reactive, tactical, and driven by “shiny objects” or short-term experimental bursts. They burn through resources without building meaningful brand value or delivering consistent revenue returns. Rather than their marketing strategy flowing from the business strategy, they start with tactics and then back peddle, attempting to understand how those tactics impacted the business.

To gauge this impact, businesses often focus on tracking engagement metrics, including website traffic, followers, likes, clicks, downloads, and form-fills. In some cases, random acts of marketing might increase these metrics. But without looking at deeper, more valuable metrics, it’s difficult to know if you’re attracting the right people capable of creating healthy, sustained growth for your business.

Healthy growth starts with your existing customers

Our conversations with business leaders almost always start with them saying they need more demand generation — more leads or “at-bats.”

Of course, generating demand is essential for your business. But when we dig deeper during these conversations, we often discover that leaders usually haven’t considered their current customers as a significant source for generating demand. This is a big miss because the quickest way to increase demand is almost always with your existing customers.

Inside your customer relationships, you have high value, low-cost opportunities. But to identify these opportunities, you first have to understand your customers by answering questions like:

- How long are we retaining our customers?

- What’s the average value of the deal or purchase from each customer?

- What’s the sentiment of our customers?

- Are our customers advocating for our business?

- Do our customers return to purchase more products or services from us?

- How much value do we generate based on customer and/or purchase type?

Once you know the answers to these questions, you can more easily find growth opportunities with existing customers, and you’re also likely to identify some customers that aren’t worth retaining. When you know the attributes of your best customers, you can focus your marketing efforts toward similar buyers who will be more likely to generate healthy growth for your business. This clear focus makes your demand generation efforts all the more impactful.

The big three revenue metrics give you insights into your existing customers or your current sales process. (Not on engagement metrics like clicks, likes, or follows.) Acting on these customer insights can accelerate the impact marketing has on your business.

The big three revenue metrics

We recommend that every growing business start tracking the following three metrics, regardless of whether a business sells directly to customers or directly to other businesses or through partner channels. Given that it’s often easier to gather and evaluate data from linear, transactional consumer purchases, our examples focus on how B2B organizations with more complex buying cycles can track and use these metrics. While these examples focus on B2B scenarios, the principles are applicable to B2C, as well.

1. Time to close

Time to close tells you, on average, how much time it takes you to move a deal from an opportunity to a closed sale.

For businesses selling to other companies, time to close is usually measured from when something becomes a deal or an opportunity in your CRM to when it closes. We recommend waiting to count something as an opportunity until both marketing and sales have qualified it. In other words, once you know that a real opportunity exists. That is the point from which you should measure time to close.

Then, the opportunity will either continue to move through your qualification process to an eventual “closed-won,” or it will fall out of the process as “closed-lost.”

When a deal is lost, it’s important to categorize it: either for continued nurture (i.e., could be a future buyer) or as fully disqualified (i.e., will never be a fit). So many businesses are hyper-focused on net-new deal creation, they forget that past prospects often make high-value future customers. Past prospects have already expressed interest and engaged in your sales process. Perhaps the timing or budget was not aligned in the first sales cycle, but if they have a positive, ongoing experience with your business, you’ll be top of mind when they are ready to purchase.

How to use time to close

Once you know your business’s time to close, you can work toward shortening it. There are typically six to ten decision-makers involved in a B2B buying group — which is no small number. Time to close provides a benchmark for understanding how long a sale takes in your business, so you can think strategically about what you can do to help move prospects more quickly and confidently through the process.

For example, what information can you provide prospects early on during the sales process to help them feel confident taking the next steps? How can you ensure you’re engaging all of the appropriate stakeholders at the right time to avoid delays in the process? And since we know B2B decision making starts before the prospect is even in your CRM, what content can you regularly distribute so that prospects entering your pipeline already have confidence in your business?

Keep in mind that a prospect’s journey with your brand often begins well before they have a defined need or become an opportunity in your CRM. A prospect’s journey usually includes several steps prior to becoming a qualified lead. They may visit the website, connect at a tradeshow, attend an event, subscribe to your newsletter, or download a piece of content. All of these moments provide an opportunity to measure “time to convert” to the next stage of engagement.

Armed with this data, marketing can help speed engagement and deal conversion through thoughtful, personalized content.

2. Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC) measures how much it costs the business to acquire a new customer. CAC can get tricky for B2B organizations because there are so many formulas to choose from when calculating it. We recommend this simple formula for companies that sell to other businesses:

Total sales & marketing investment (cost of sales staff, marketing staff, and program costs) ÷ # of new deals won in an annual cycle = Customer Acquisition Cost

How to use CAC

Once you know your organization’s CAC, you can use it to evaluate your team and program investments compared to your returns to determine if adjustments are necessary. You may consider:

- Based on how much we’re investing, are we getting the returns we expect in terms of new business and client retention?

- Could we get a greater return if we invested more into our people and programs?

- Do we have the right balance of sales and marketing staff and programs?

Hubspot’s article on this topic goes into more depth, including some CAC examples based on different business models.

3. Customer Lifetime Value (CLV)

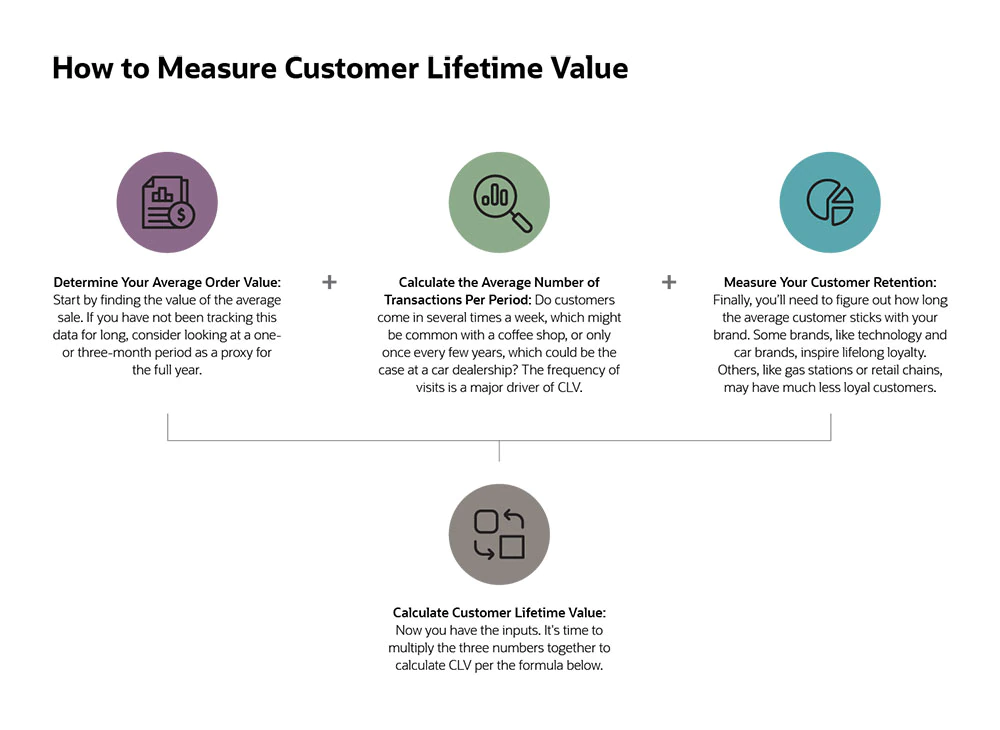

Customer Lifetime Value (CLV) is the measure of the overall value of a buyer / account to your organization. This value can be measured simply as revenue, or through more nuanced calculations that account for cost of goods sold, overall profitability, and more. The key is to decide on the formula that fits your business, and stick to it consistently.

To calculate CLV (or almost any other revenue metric), you will need to access existing data through your ERP and/or CRM systems. If your business does not have the technology in place to track customer purchase data over time, you’ll first need to put the right systems in place, and give your organization time to compile a reasonable amount of baseline data.

Companies selling to other businesses can calculate their Customer Lifetime Value (CLV) with the following formula:

Average Deal Value x Number of Deals x Time Retained = Customer Lifetime Value (CLV)

For businesses that operate by subscription or retainer, the calculation may be even simpler, because buyers are not coming in and out of the purchase cycle, but are engaged through continual, predictable spend. At Authentic, we engage through monthly continuous retainers, so our CLV calculation is quite simple:

Average Monthly Retainer Value x Continuous Months Engaged = CLV

Netsuite has a very detailed article on this topic, which includes this helpful graphic:

How to use CLV

Even companies that know how important CLV is need to revisit the metric regularly to measure it and identify opportunities for increasing or repositioning the CLV.

For example, we recently went through an exercise at Authentic to re-evaluate our CLV. In doing so, we realized that our sales and onboarding messaging was actually depleting our ability to build onto our customer lifetime value. We were casting a narrative that short-changed both our company and our customers. Our data showed that the longer clients stayed with us, the stronger their results were.

Since recognizing this, we’ve changed our narrative and now set expectations differently across all touchpoints, from our website to sales materials to our onboarding process. Regularly tracking and evaluating your company’s CLV can help you uncover similar insights, so you can make adjustments to positively impact the business.

Begin by putting the systems in place to measure these metrics

If reading this guide has overwhelmed you because you know you don’t have the data necessary to measure these metrics effectively, know that you are not alone. Despite the influx of data available to us today, growing businesses often lack access to the right data.

Your next best step is to put the tools, systems, and processes in place to capture this data. Eventually, after gathering enough baseline data over time, you can move from just having information → generating insights → conducting forecasts → building predictive models. While building predictive models might seem daunting now, the best thing you can do today is to start by simply gathering the right data.

Are you ready to achieve healthy growth?

When you track these three big revenue metrics, you also begin to uncover insights that define who your most ideal customers are. Which customers get through the sales process the quickest because of the value you provide them? Which customers are the most profitable because of the products or services they purchase? Which of your customers does it take the least convincing to convert, again because of the value you offer them? And finally, which customers are most loyal because you continue to provide that same value again and again over time?

When you know the answers to these questions, your marketing team and programs can focus on bringing in your best, highest value customers to your pipeline. Then, your sales team can close them faster, generate revenue quicker and more confidently, and for a more extended period. These are the building blocks for healthy, sustainable business growth — and it all starts with marketing.

While this sounds great on paper, we know it isn’t easy to put these building blocks in place without strategic marketing leadership. This challenge is what led us to start Authentic and establish our Authentic Growth Methodology™.

Our methodology is a framework that ensures that our clients answer the most critical questions within their businesses, helping them find their greatest growth opportunities. We help growing businesses focus on the right questions, so they’re not distracted by shiny object marketing, which often tempts companies to churn out more marketing activities with little to no return. Instead, Authentic empowers clients to point all marketing activity toward purposeful, healthy, and sustained growth.

Would you like to discuss how Authentic can help you build this growth in your business? Let’s connect to discuss.